Cryptocurrency Exchange Development Features, Benefits and Cost

Cryptocurrency exchanges have become the cornerstone of the digital financial system, offering platforms that allow users to buy, sell and trade cryptocurrencies. As the cryptocurrency market continues to grow, understanding the development costs, features, and benefits of cryptocurrency exchange development is increasingly important for businesses looking to enter this space.

This comprehensive guide contains everything you need to know about the benefits, features, and costs of cryptocurrency exchange development. Whether you’re a startup aiming to launch a new revolution or an based cryptocurrency exchange company looking to grow in the cryptocurrency market, this guide will provide you with valuable insights to help you succeed.

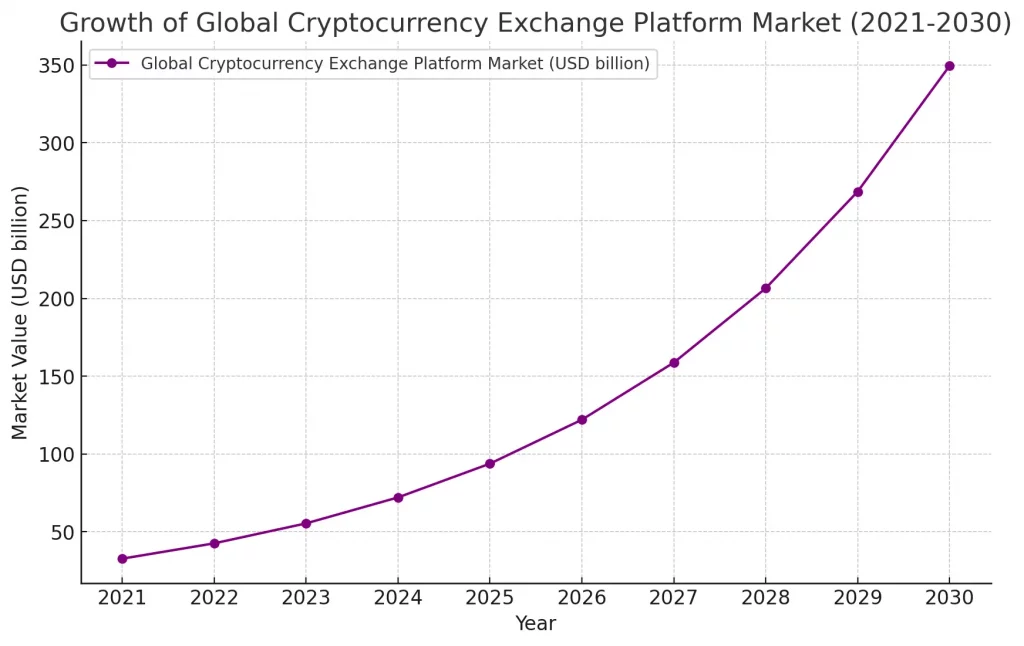

Market Overview

The global cryptocurrency exchange platform market was valued at USD 32.77 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 30.08% from 2021 to 2030. By 2030, the market size is projected to reach USD 347.50 billion. The Asia Pacific region is expected to be the fastest-growing market during this period, driven by increasing adoption and technological advancements.

Source:- spherical

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital platform where you can buy and sell cryptocurrencies such as Bitcoin, Ethereum Blockchain, and many others and trade them. It is considered an online marketplace for cryptocurrencies, similar to a stock exchange but where digital coins are exchanged for currency. You can use these exchanges to convert traditional money (such as dollars or euros) into cryptocurrencies. Additionally, they provide tools for managing your digital assets and tracking market prices.

Types of Cryptocurrency Exchanges

There are three types of cryptocurrency exchanges:

-

Centralized Exchanges

Centralized exchanges (CEX) are platforms managed by a central authority. They offer high liquidity, a user-friendly interface and advanced trading features, which make them popular among traders and users. Users must trust the exchange with their funds, as it holds the private keys. Despite their benefits, CEXs are highly vulnerable to hacking and legal reviews, which can affect user trust and security.

Advantages of Centralized Exchanges:

-High liquidity

-User-friendly interfaces

-Advanced trading features

-Customer support -

Decentralized Exchanges

Decentralized Exchanges (DEXs) operate without a central authority they are using blockchain development to facilitate peer-to-peer trading. Users maintain control of their private keys and funds, enhancing security and privacy. While DEX development offers lower fees and reduced hacking risks, they often suffer from lower liquidity and limited trading features compared to centralized exchanges, making them less suitable for high-frequency trading.

Advantages of Decentralized Exchanges:

-Enhanced security and privacy

-Reduced risk of hacking

-Lower fees

-Greater transparency

Also Read: What is a DEX? How do Decentralized Exchanges Work? -

Hybrid Exchanges

Hybrid exchanges strive to merge the best aspects of both centralized and decentralized exchanges. They deliver the high liquidity and advanced functionalities typical of centralized exchanges (CEXs), while also incorporating the enhanced security and privacy features found in decentralized exchanges (DEXs). This allows users to benefit from a balanced trading experience, enjoying both sophisticated trading tools and greater control over their assets. Despite these advantages, hybrid exchanges can be challenging to implement due to their complexity and may encounter regulatory hurdles that affect their adoption and operational efficiency.

Advantages of Hybrid Exchanges:

-Improved security and control

-Enhanced liquidity

-Comprehensive trading features

-Balanced user experience

Read More: Understanding Decentralized Exchange (DEX): The Peer-to-Peer Marketplace for Cryptocurrency Swapping

Essential Features of a Cryptocurrency Exchange

A robust cryptocurrency exchange is built on several key features that ensure security, efficiency, and a seamless user experience. Let’s explore these essential components:

-

User Registration and Two-Factor Authentication

User registration is the initial step where users create accounts by providing the necessary details. To enhance security, exchanges implement two-factor authentication (2FA), requiring users to verify their identity through an additional method, such as a code sent to their phone. This layer of security helps protect accounts from unauthorized access.

-

Crypto Matching Engine or Trading Engine

At the core of any cryptocurrency exchange is the trading engine, responsible for matching buy and sell orders. This engine ensures that trades are executed swiftly and accurately, maintaining the platform’s efficiency. It handles order types, manages order books, and ensures fair pricing by matching orders based on price and time priority.

-

User Interface and Experience

A user-friendly interface is necessary for attracting and retaining users. A well-designed interface provides easy navigation, clear display of market data, and intuitive tools for trading. It enhances the overall user experience, making it accessible even for beginners while providing advanced features for experienced traders.

-

Wallet Integration

Cryptocurrency exchanges must integrate secure wallets for storing digital assets. These wallets can be hot (online) or cold (offline) storage solutions. Proper crypto wallet integration ensures that users can deposit, withdraw, and manage their cryptocurrencies safely and efficiently.

Read More: Multi Cryptocurrency Wallet Development: Complete Guide -

Payment Gateway Integration

To facilitate transactions, exchanges need payment gateway integration. This allows users to deposit and withdraw funds using various payment methods, including bank transfers, credit cards, and other digital payment options. A seamless payment gateway integration ensures smooth financial transactions on the platform.

-

Liquidity Management

High liquidity is essential for a successful exchange as it ensures that users can easily buy and sell assets without significant price fluctuations. Effective liquidity management involves partnering with liquidity providers and implementing mechanisms to maintain sufficient order book depth.

-

Admin Panel

An admin panel is important for the backend management of the exchange. It provides administrators with tools to monitor and manage the platform, including user accounts, transactions, compliance, and security settings. A comprehensive admin panel ensures the smooth operation and regulatory compliance of the exchange.

-

Customer Support System

Providing efficient customer support is vital for user satisfaction. A robust customer support system includes various channels like live chat, email, and phone support, along with a comprehensive FAQ section. Prompt and effective support helps resolve user issues and builds trust in the platform.

Benefits of Developing a Cryptocurrency Exchange

-

Revenue Generation

Cryptocurrency exchange development can be highly profitable for users. Exchanges earn revenue through transaction fees, listing fees, withdrawal fees, and other service charges. With the growing popularity of cryptocurrencies, a well-managed exchange can attract a large user base and generate significant income.

-

Market Liquidity

By creating a cryptocurrency exchange, you contribute to the overall liquidity of the crypto market. Increased liquidity benefits all market participants, making it easier to buy and sell assets quickly without causing large price fluctuations. This, in turn, attracts more traders to your platform, creating a positive cycle of growth and stability.

-

Enhanced Security

Building your own exchange allows you to implement robust security measures tailored to your specific needs. Advanced security protocols, such as two-factor authentication, encryption, and cold storage for funds, help protect users’ assets and personal information. A secure exchange builds trust and credibility, essential for attracting and retaining users.

-

User Empowerment

A cryptocurrency exchange empowers users by providing them with a platform to trade and invest in digital assets. It offers users control over their investments, access to a diverse range of cryptocurrencies, and the tools to manage their portfolios effectively. Empowered users are more likely to engage actively and remain loyal to your platform.

-

Innovation and Customization

Developing your own exchange gives you the flexibility to innovate and customize the platform according to market demands and user preferences. You can introduce unique features, integrate new technologies, and continuously improve the user experience. This adaptability helps you stay competitive in the fast-evolving crypto industry.

-

Global Reach

A cryptocurrency exchange has the potential to attract users from around the world. Cryptocurrencies operate on a global scale, and your exchange can cater to international traders, investors, and institutions. By offering multi-language support, diverse payment options, and compliance with various regulations, you can tap into a global market and expand your user base significantly.

Cost of Developing A Crypto Exchange App

Developing a crypto exchange app involves a significant financial investment, with costs influenced by various factors:

- Type of Exchange: Centralized, decentralized, or hybrid exchanges vary in complexity and expense.

- Features and Functionalities: High-frequency trading, multi-currency support, and robust security measures increase costs.

- Development Team: Hiring an experienced crypto exchange development company or partnering with a specialized firm affects the budget.

- Technology Stack: Choosing advanced programming languages, frameworks, and blockchain development platforms impacts expenses.

- Security Measures: Implementing strong security features adds to the cost.

- Compliance and Legal Fees: Ensuring regulatory compliance and obtaining licenses require additional investment.

- Maintenance and Updates: Post-launch support and regular updates contribute to ongoing expenses.

Developing a basic crypto exchange app ranges from $200,000 to $500,000, while more complex platforms can exceed $1 million. Investing in quality development and security is essential for building a reliable and competitive exchange.

LET’S CONNECT TO DISCUSS A PROJECT

Steps to Develop a Cryptocurrency Exchange

-

Market Research and Planning

The first step in a cryptocurrency exchange development is conducting thorough market research. This involves understanding the current market trends, identifying your target audience, analyzing competitors, and determining the regulatory requirements. Proper planning helps you outline the features and functionalities your exchange will offer, setting a clear roadmap for the cryptocurrency exchange development process.

-

Selecting the Right Technology Stack

Choosing the appropriate technology stack is important for the performance and security of your crypto exchange. This includes selecting programming languages, frameworks, and tools for both the front-end and back-end development. Common technologies include JavaScript, React, Node.js, Ruby on Rails, and various blockchain technologies. The chosen stack should support scalability, security, and efficiency.

-

Designing the Exchange Architecture

Designing a robust architecture is essential for the smooth operation of your exchange. This involves structuring the core components such as the trading engine, user interface, crypto wallet integration, payment gateway, and security protocols. The architecture should ensure high availability, fault tolerance, and seamless interaction between all components.

Read More: Cryptocurrency Exchange Development: A Complete Guide -

Development Phase

During the development phase, the actual coding of the exchange begins. This includes building the front-end interface for users, developing the back-end server-side logic, integrating third-party services, and implementing security measures. The trading engine, which matches buy and sell orders, is a critical component that needs meticulous attention. This phase also involves setting up databases, developing APIs, and ensuring data encryption.

-

Testing and Quality Assurance

Rigorous testing is essential to ensure the exchange operates flawlessly. This includes unit testing, integration testing, and performance testing to identify and fix bugs. Security testing is particularly crucial to safeguard against vulnerabilities. Quality assurance ensures that the exchange meets all functional and non-functional requirements, providing a seamless user experience.

-

Deployment and Launch

Once the exchange passes all testing phases, it is ready for deployment. This involves setting up the production environment, migrating data, and configuring servers. A soft launch or beta testing phase can help gather user feedback and make final adjustments. The official launch should be well-coordinated with marketing efforts to attract users to the platform.

-

Post-Launch Support and Maintenance

After the exchange is live, continuous support and maintenance are necessary to ensure its smooth operation. This includes monitoring the system for performance issues, applying security patches, updating features, and providing customer support. Regular maintenance helps in addressing any emerging issues and keeping the exchange up-to-date with the latest technological advancements and regulatory changes.

Also Read: How to Choose the Right Altcoin Development Company?

Conclusion

This guide has highlighted the key factors involved in the development of a cryptocurrency exchange, from understanding the costs and essential features to recognizing the benefits and challenges. By emphasizing user security, interface usability, liquidity management, and customer support, operators can create a robust and competitive exchange platform.

Future trends in cryptocurrency exchanges are likely to include increased adoption of decentralized finance (DeFi) development, integration of advanced technologies like artificial intelligence (AI), blockchain and machine learning (ML), and enhanced regulatory frameworks. As the crypto market continues to evolve, exchange operators need to stay abreast of these developments and adapt their platforms accordingly. In the final analysis, a cryptocurrency exchange development solution requires careful planning, strategic decision-making, and ongoing commitment to meeting the needs of users in this dynamic and rapidly expanding industry.

Mr. Saddam Husen, (CTO)

Mr. Saddam Husen, CTO at Comfygen, is a renowned Blockchain expert and IT consultant with extensive experience in blockchain development, crypto wallets, DeFi, ICOs, and smart contracts. Passionate about digital transformation, he helps businesses harness blockchain technology’s potential, driving innovation and enhancing IT infrastructure for global success.

Based on Interest

Why You Need Creative SaaS Software Developers for a Unique Project?

Businesses across industries are adapting Software-as-a-Service (SaaS) software solutions to streamline organization operations, improve customer experiences, and gain a competitive edge. However,…

Why You Need Creative SaaS Software Developers for a Unique Project?

Businesses across industries are adapting Software-as-a-Service (SaaS) software solutions to streamline organization operations, improve customer experiences, and gain a competitive edge. However,…

Why You Need Creative SaaS Software Developers for a Unique Project?

Businesses across industries are adapting Software-as-a-Service (SaaS) software solutions to streamline organization operations, improve customer experiences, and gain a competitive edge. However,…