Our Latest blog

10 Leading Crypto Exchange Development Companies to Watch in 2025

Crypto exchange promises to bring heavy evolution across the globe. Moreover, projected revenue in cryptocurrencies is estimated to reach US$95.1 billion by…

India’s Leading Cloud Hosting Providers 2025: CloudMinister, AWS, Azure, GCP & More

Amongst the vibrant streets of India's startup centers and enterprise IT corridors that buzz day and night, there is one certainty —…

The Ultimate Guide to Blockchain Wallet Development

Blockchain technology is changing the way we save, transfer, and invest money. Blockchain wallets are at the center of this change, providing…

The Complete Guide to Quick Commerce App Development in 2025

In today’s fast-paced world, Quick Commerce (Q-Commerce) is changing the way people shop online. No one wants to wait 2–3 days for…

AI-Based Crypto Trading App Development Cost

Planning to launch a new AI-based Crypto Trading Platform? Learn about the costs from the detailed guide provided below. This blog will…

Blockchain Identity Management : Beginner’s Guide 2025

Every day, thousands of people share their personal information and data with websites and apps that can be easily hacked or misused.…

How to Make an App Like DoorDash, Uber Eats, or GoPuff

In a world where instant fulfilment drives consumer habits, Make an apps like DoorDash, Uber Eats, and GoPuff have change the way…

White Label Mobile App Development: What It Is, How It Works, and Who Needs It

What Is White Label App Development? White label mobile app development is the process of building a ready-made mobile or web…

How Much Does It Cost to Develop a Lab Management App?

In today’s data-driven healthcare and research landscape, laboratories need more than manual logs and spreadsheets to manage operations. They need automation, accuracy,…

30+ Best App Ideas for Startups in 2025: Profitable, Trending & Launch

Starting a business in 2025 requires an understanding of the digital landscape, and mobile apps continue to play a huge role…

Top Mobile App Testing Tools in 2025: Free, Automated & for Android/iOS

Introduction In 2025, the mobile app development industry will continue to grow at an unprecedented pace. With billions of active mobile devices…

Top 7 Mobile App Development Frameworks in 2025

The mobile app development industry has seen remarkable growth, driven by the increasing demand for apps across all sectors, from e-commerce to…

TaskRabbit Clone App Development in 2025: Features, Cost, Benefits & Trends

Introduction In today's fast-paced world, the demand for on-demand service apps is surging, with platforms like TaskRabbit becoming indispensable. These apps…

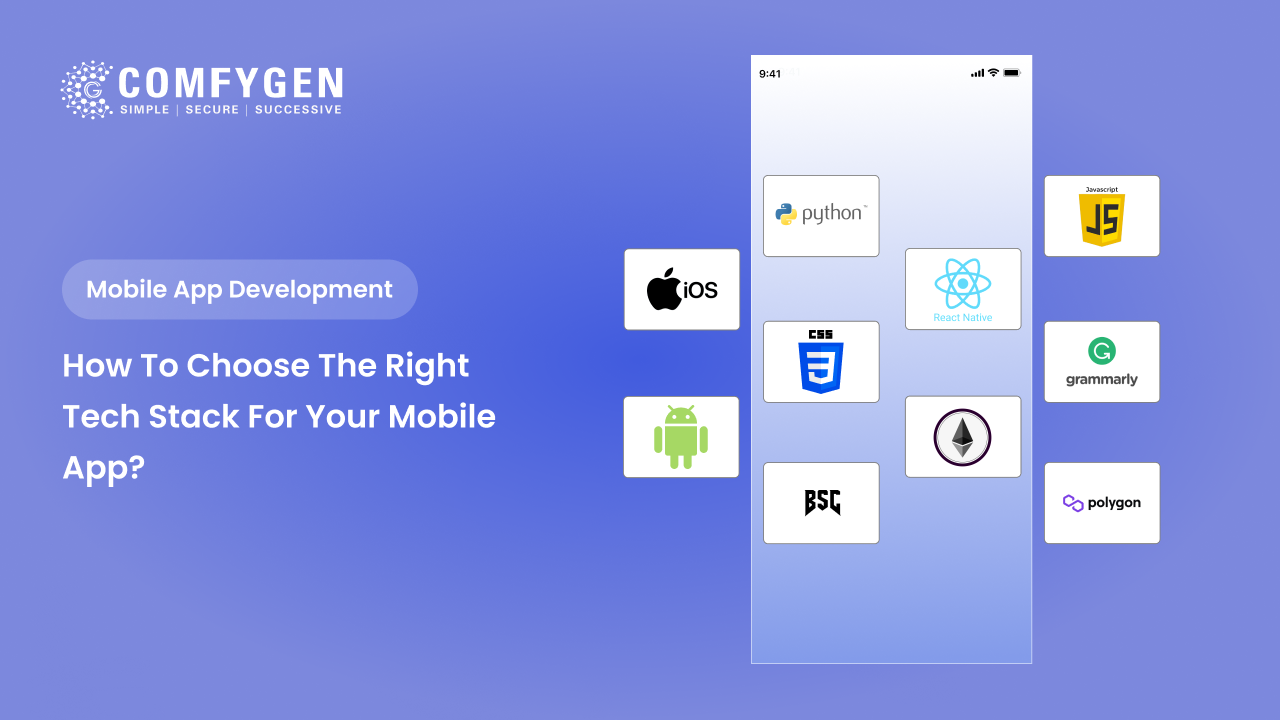

How to Choose the Right Tech Stack for Your Mobile App?

Choosing the right technology stacks for mobile app development is very significant because that will make your application reliable, secure, and seamlessly…

Top Mobile App Development Trends to Watch in 2025

Mobile apps became a necessity in the evolving marketplace and lifestyles. Therefore, demand for mobile app development increased, so, significantly, you should…

Santa-fying Your Merry Christmas with our Fun Game Development

Comfygen is your go-to for creating awesome Christmas games! Our skilled team of game developers can turn your holiday game ideas into…