Ensuring AML Compliance in the NFT Ecosystem

Ensuring AML Compliance in the NFT Ecosystem

In today’s digitally advanced world AML compliance in the NFT ecosystem has increased, the security of digital assets is highly important to protect them from potential financial risks.

Financial institutions across the world implement AML security measures to protect and safeguard themselves and their clients from fraudulent and criminal activities. When effective AML compliance measures are established in the NFT marketplace KYC, it results in building trust, ensuring long-term sustainability and mitigating the risk of the industry. The requirement of AML compliance in the NFT ecosystem has increased due to the rising number of money laundering cases.

AML compliance has now become a necessity in NFT. It acts as a protective barrier and a shield for both the financial service providers and their clients. The anti-money laundering software market has already reached a valuation of $1.77 billion by 2023.

In this blog let’s discuss more on AML requirements, guidelines, and best practices in NFTs. Also, the below section will give you a basic idea of addressing cross-border AML Challenges in NFTs and training and awareness.

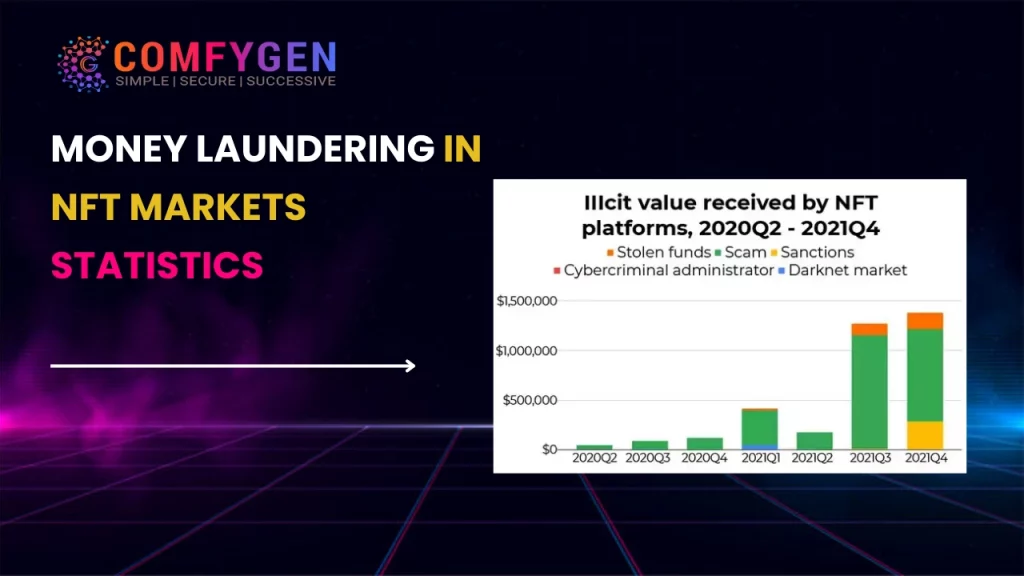

The illegal address reach to NFT markets increased highly in the third quarter of 2021, which surpassed the $1 million cryptocurrency. It continued growing in the fourth quarter and reached nearly $1.4 million. Money laundering cases cost the world around 2% to 5% of its GDP.

A practice known as wash trading (an illegal process of buying a company’s stock through one broker and selling the stock through another broker) has been observed in the NFT market, which involves transactions between NFT sellers and buyers at the same time.

According to pseudonymous researcher Hildobby’s analysis on December 16th, wash trading accounted for more than half (58%) of the total NFT transaction volume on Ethereum in the year 2022. This tactic reached its peak in January, with wash transactions accounting for over 80% of the total NFT trading volume that specific month.

According to the Chainalysis report, 110 NFT owners profited with $ 8.9 million from wash trading.

Overview Of NFTs

An NFT or non-fungible token development services is a unique digital asset that represents proof of ownership or authenticity of a specific item or content. By allowing digital assets to be bought, sold, and traded in a secure and verifiable manner, it has become popular in various industries, such as art, music, and gaming. NFT is fully based on blockchain development technology and provides a decentralized and completely transparent record of ownership.

What is Anti-Money Laundering?

Anti-Money Laundering (AML) is a protective measure taken against money laundering cases and fraudulent activities in the financial markets. AML includes extensive laws, policies, and regulations for the prevention of financial crimes and fraudulent and illegal activities. Global and local regulators have been established around the world, and they develop guidelines and regulations to prevent financial crimes and criminal activity. The mission to combat money laundering requires institutions to take appropriate measures to protect themselves and their economies from suspicious financial crime.

The Anti-Money Laundering process targets a wide range of crimes, starting from corruption and tax evasion to market manipulation, illegal trade, and terrorist financing, as well as attempts to disguise these activities as sources of funds. The introduction of effective anti-money laundering procedures has far-reaching implications for crime reduction, as most criminals and terrorists rely heavily on laundered funds for their illicit activities.

Risks and Challenges for AML Compliance

Anti-money laundering (AML) has turned into a critical issue in the financial sector across the world. This is because of the rapid participation of individuals in financial means via digitalization. However, apart from the strategic implementation of AML compliance measures, challenges and risks are noticed in inspecting, detecting, and preventing money laundering. This has become a significant concern for regulatory authorities and financial institutions. Let’s check out the risks and challenging factors for AML compliance.

Complexity in Money Laundering

There is so much complexity in money laundering activities and methods. Criminals constantly discover new ways to launder money. As the digital world advances, criminals take advantage of digitisation to strengthen their illegal processes. This makes it difficult for financial institutions to detect suspicious activities.

For example, money launderers rely on shell companies, digital currencies, and offshore accounts to hide the origin of funds. In addition, they prefer to use complex transaction procedures such as layering and consolidation, which make it impossible for financial institutions to track and trace the origin of the funds.

Lack of Data and Technology Resources

Financial institutions may not have access to data and technical resources, i.e., necessary for effective detection of money laundering activities. For example, financial service providers in the NFT marketplace may not have sufficient access to customer data and transactional and third-party data. Also, they may lack analytical tools, which are crucial to identify suspicious activity. In addition, both small and medium-sized enterprises, in particular, suffer due to a lack of compliance personnel, teams, and resources.

Continuously Expanding Regulatory Landscape

In today’s constantly changing digital world, regulatory frameworks are never static. It keeps on continuously evolving. Money services businesses often find it difficult to adopt the ever-evolving anti-money laundering (AML) regulations. Hence, the fluid nature of these regulations turns out overwhelming to Money services businesses. Further, it leads to potential weaknesses and vulnerabilities in compliance.

Higher Compliance Cost

AML compliance involves a considerable requirement of financial commitment. This commitment covers the necessity for specialised expertise. It also includes state-of-the-art technology with evolved advancements and consistent audits. For many Money Service Businesses (MSBs), these requirements can seem like a sheer price to pay, weighing heavily on their operational budgets.

Involvement of Complicated Technology and Procedures

AML compliance includes complex processes and technology. For example, know-your-customer (KYC) integration. These procedures are usually heavily complicated and time-consuming. Also, they are combined with the organisations’ systems and databases, making things more complicated. Data quality needs to be standardised and enhanced for analysis of financial criminal activity. It is not easy to achieve because data is stored in various formats and systems in the organisation.

What are the AML Requirements for NFT Market Participants?

The complete regulatory landscape of AML in NFT marketplaces is constantly evolving across the world. The reason behind it is to address challenges in the financial sector. Moreover, the specific regulations vary across jurisdictions. In fact, there are key elements that shape the regulatory frameworks for AML in NFT market participants. Let’s check out the requirements in detail;

AML Regulations Requirements

NFT marketplaces are subjected to the existing regulations of AML. This is applicable to financial institutions and digital asset services. The existing regulations need CDD – customer due diligence, suspicious transaction monitoring, and obligation reporting to regulatory authorities.

KYC and Customer Identification

KYC – ‘Know your customer’ policy is a crucial process in Anti Money Laundering compliance. Financial regulators ask the NFT marketplace development for the implementation of robust KYC processes. This aids them in verifying the user’s identity. Moreover, they can perform risk assessments and collect the required information to inspect, detect, and prevent illegal activities.

Licensing and Registration Requirements

There are jurisdictions that introduce both licensing and registration requirements for the participants of NFT marketplaces. It treats them as an authorised virtual digital service provider. These specific requirements aim to comply with AML regulations. It further enhances regulatory oversight over the platforms.

Transaction Monitoring and Reporting

Financial regulators want NFT marketplaces to integrate systems in order to monitor transactions. Also, to identify and detect suspicious activities. The platforms have to report suspicious transactions to the relevant regulatory authorities for further investigations. This eventually prevents financial crimes.

Cross-Border Considerations

NFT marketplaces offer cross-border transactions, which further complicates compliances and regulations. Regulators keep on working to improve international regulation, cooperation and data sharing to address the issues and risks of money laundering cases in cross-border NFT transactions.

Know Your Customer (KYC) Protocols

Know Your Customer (KYC) protocols play a major role in AML compliance in NFT marketplaces. It aids in verifying a user’s genuine identity. It is also helpful to assess risk profiles and collect relevant information. These will eventually prevent money laundering activities, along with other illegal activities.

Here are the key components included in the KYC procedures of the NFT marketplace:

User Identification

NFT Marketplaces require users to provide reliable and true identification. For example, an ID Card issued by the government, a passport, or a driver’s licence. These documents will undergo extensive verification of the user’s identity. The process ensures that the user is not using any fraud or stolen identity.

Proof of Address

NFT Marketplace asks for a proof of address for their users. The address proof includes utility bills, official documents, bank statements, or others to verify the residence address. It lets them create a comprehensive and true user profile and reduces the risk of fraud.

Enhanced Due Diligence (EDD)

In some cases, NFT Marketplaces have to perform enhanced due diligence on their users where there is a suspicion of high-risk transactions. EDD measures include high-quality procedures such as additional steps of verification, monitoring of suspicious activities, and background checks to comply with AML regulations.

Risk Assessment

NFT marketplaces have to perform a risk assessment of the users to determine the AML scrutiny level requirement. There are several factors, such as volume of trading, frequency, sources of funding, and legal risks; all these need to be considered while assessing a user’s risk profile.

Ongoing Monitoring

NFT marketplaces require a system which can continuously monitor and track user transactions and activities. Suspicious activities such as large transactions and sudden changes in user behaviour will lead to further investigation. If it is found appropriate, it will be further reported to regulators.

Record-Keeping

NFT marketplaces have to maintain a record system to store user information. It also stores user identification documents, transaction receipts, and any related data. These records need secure storage and are easily accessible for auditing purposes.

Enforcing AML Guidelines and Best Practices

The AML regulations will vary from country to country. However, the guidelines and best practices of AML compliance will always remain the same. These are set up to ensure your financial services are protected from financial crime, hacks, and illegal activities regardless of region.

Written Policies

AML compliance comes with a set of rules that offer a higher level of protection and benefits when followed strictly. The finance organisational policies must be made according to the AML regulations. It should be stated clearly and should be written out for all the members, including executives and regulators. When written policies are built and followed, it becomes an efficient way to secure the organisation from financial crime.

Compliance Officer

Almost every financial institution should have a compliance officer who will take the entire responsibility for the entire KYC and AML procedure. It is a necessary standard industrial practice to assign a professional to ensure all the processes. The individual will also take the responsibility to update information regularly.

AML Red Flags

Money laundering includes converting illegal funds into legal funds. There are several patterns and techniques commonly used by money launderers. This will increase the chances of becoming a victim of a scam by paying attention to basic warning signs.

Regular Reviews

It is very easy for businesses to comply with AML regulations. Unfortunately, there are financial institutions and organisations that tend to forget about compliance once they have already done so. Regular audits are important to ensure the security of your business. Regularly review all aspects of AML compliance to stay on top of the situation.

What are the Surveillance Tools for Detecting Suspicious Activity?

Advancements in digital technology have led to the invention of surveillance tools and solutions to detect and prevent fraud in NFT. By utilising the latest technology, financial institutions will reduce the risks associated with fraudulent transactions and further tighten security.

The tools and technologies will offer robust account security for users. This will lead to increased user trust and provide a highly secure environment for conducting NFT transactions. Here are some of the technological solutions that NFT companies may consider to detect suspicious activities:

AI Tools

In today’s advanced generation, AI tools are available to detect NFT scams. It will instantly detect suspicious activity and other potential scams.

Blockchain Development Tools

Blockchain development technology is integrated with inherent security features such as transparency and immutability. This will let the financial businesses leverage their secure record and verify the identification and authenticity of NFTs. The tools come with decentralisation features to reduce the risk of tampering, forgery, or unauthorised modification of NFT data.

Smart Contracts

With the help of smart contracts, self-executing contracts will be encoded on the blockchain development agency. Financial institutions can automate and enforce the terms of NFT transactions. The smart contract development services idea will secure transactions without any intermediaries and reduce the risk of fraud.

Metadata Analysis

Businesses should employ advanced algorithms equipped with machine learning models to analyse the metadata related to NFTs. It will help to detect anomalies and identify counterfeit work and fraudulent activity.

Fraud Detection Algorithms

Fraud Detection Algorithms will help companies to analyse transaction data, user behaviour, and other activities to identify patterns and behaviours associated with fraudulent NFT transactions.

Monitoring Tools and Platforms

There are a number of monitoring tools available that are specifically designed to detect fraudulent listings or activity of NFT. It offers real-time alerts and insights. These tools further allow companies to continuously monitor NFT marketplaces, along with online communities, for potential fraud, fake listings, or IP abuse.

How to Address Cross-Border AML Challenges in NFTs?

NFT marketplaces are now operating across the globe. It allows users from various jurisdictions to take part in the transactions. The cross-border transactions bring complexities and compliance to AML, which leads to risks and challenges. Here are the ways to address the Cross-Border AML Challenges in NFTs.

Implementation of Enhanced Due Diligence

Enhanced due diligence should be conducted on every party involved in cross-border transactions. It must be performed on high-risk users. It includes evaluating the origin of funding sources and understanding the transaction purpose.

Transaction Monitoring

Financial organisations must have advanced transaction monitoring systems for detecting suspicious transaction patterns. It will further define thresholds for suspicious user behaviours, which further trigger alerts.

Development of Risk Based Approach

With the establishment of a risk-based AML approach, financial institutions can assess and evaluate cross-border risks associated with products, geographic locations, customers, and services.

Third-Party Management

The service providers should assess and manage the Anti Money Laundering risks that are associated with third-party relationships. For example, this can be vendors, intermediaries and agents. Third parties must undergo enhanced due diligence with high-quality monitoring and screening.

Cross-Border Regulatory Compliance

Financial businesses need to be aware of the AML regulations not only of their own country but also of the foreign jurisdictions especially the places they are operating their services. Compliance requirements can vary widely in different regions. Therefore, it is important to comply with every government regulation.

AML Training and Awareness

AML training and awareness programs include both individuals and organisations to support with the fundamental knowledge to identify, manage, address, and assess the risks associated with money laundering activities. It will further help in the establishment of highly effective risk management strategies. Moreover, it will protect and safeguard against potential threats, which include various risks such as operational, reputational, and financial risks.

The cornerstone of a compliance culture and policy in a financial company is conducting regular training and awareness. Companies should regularly train their employees to keep them updated with the latest AML laws and regulations. Further, it will make them aware of the responsibilities they have towards the organisation to report suspicious activities like transactions and meet expectations.

AML and KYC training and awareness programs must cover at least the following broad areas: identifying and reporting transactions that must be reported to regulatory or governmental authorities. Different forms of money laundering activities and serious risks, such as terrorist financing, are related to the institution’s products and services.

Training and Awareness Methods

-

Induction training related to money laundering recognition, prevention, and reporting of suspicious activities.

-

Selecting staff members who have the ability to handle or can take managerial responsibility for handling transactions that may involve money laundering cases.

-

On-going training should be given to the staff at required intervals to keep them aware of developments in the field of AML.

-

Awareness of legal requirements contained in the PMLA and the rules and regulations framed under it.

-

Awareness of policies and procedures that will be helpful to prevent money laundering activities.

-

Awareness of KYC and AML guidelines is issued by the governments of various countries.

Conclusion

The only process that can combat money laundering activities in NFT is the implementation of AML – Anti Money Laundering. The financial institutions must follow the guidelines and best practices and stay updated with the rules and regulations of the AML. Apart from this, they must be aware of the technological advancements, developments and trends in AML. Organisations must be aware of tools that will help them in detecting fraud and suspicious transactions in NFT marketplaces. Most importantly, the focus must be on AML training and awareness to make the employees aware of illegal activities.

FAQ’S

Is KYC required for NFT?

NFT issuers and users must understand and go through the legal obligations and take the necessary steps to comply. Implementing a robust KYC system for NFTs will ensure compliance and reduce the risk of money laundering activities in the NFTs marketplace.

Does OpenSea require KYC?

OpenSea, which is the biggest NFT marketplace, does not require KYC. However, there is a measure that is aimed at achieving compliance with best market practices, but it isn’t mandatory.

Why is KYC important for the marketplace?

One of the major reasons for introducing KYC in financial markets was to reduce and prevent fraud, money laundering, and tax evasion activities. For this, the services have to determine the source and destination of their users’ financial transactions.

Having detailed information about the customers protects either party in the business transactions and relationships. KYC serves the important purpose of providing superior service and avoiding liability and associations with money laundering.

How are NFT marketplaces regulated?

NFT marketplaces have to comply with AML regulations that include KYC procedures to prevent money laundering activities and terrorist financing. It will require the implementation of processes such as transaction monitoring and identity verification.

Is KYC required for NFT?

Does OpenSea require KYC?

Why is KYC important for the marketplace?

How are NFT marketplaces regulated?

Mr. Saddam Husen, (CTO)

Mr. Saddam Husen, CTO at Comfygen, is a renowned Blockchain expert and IT consultant with extensive experience in blockchain development, crypto wallets, DeFi, ICOs, and smart contracts. Passionate about digital transformation, he helps businesses harness blockchain technology’s potential, driving innovation and enhancing IT infrastructure for global success.

Based on Interest

Blockchain Consulting Services: Transforming Your Business with Cutting-Edge Blockchain Solutions

Introduction Blockchain technology is revolutionizing industries by providing secure, decentralized, and transparent solutions. As businesses across the world explore their potential,…